The total market cap of all cryptocurrencies is now $414 billion. But, after the novelty wears off somewhat, there might be something of a shakeout, with the focus moving towards cryptos’ usefulness as a means of commerce, rather than a speculative toy. At first, people like to go with what other people are using.

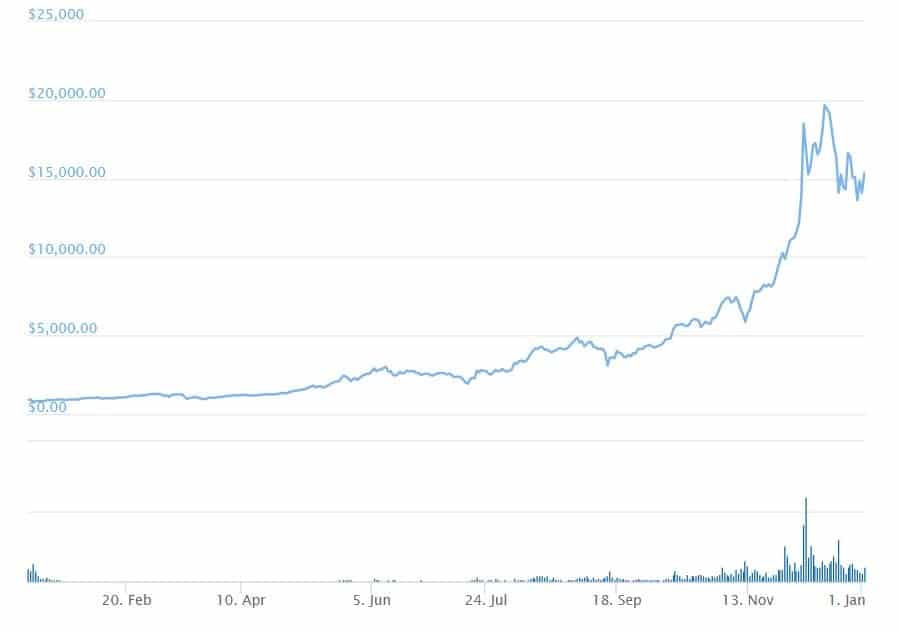

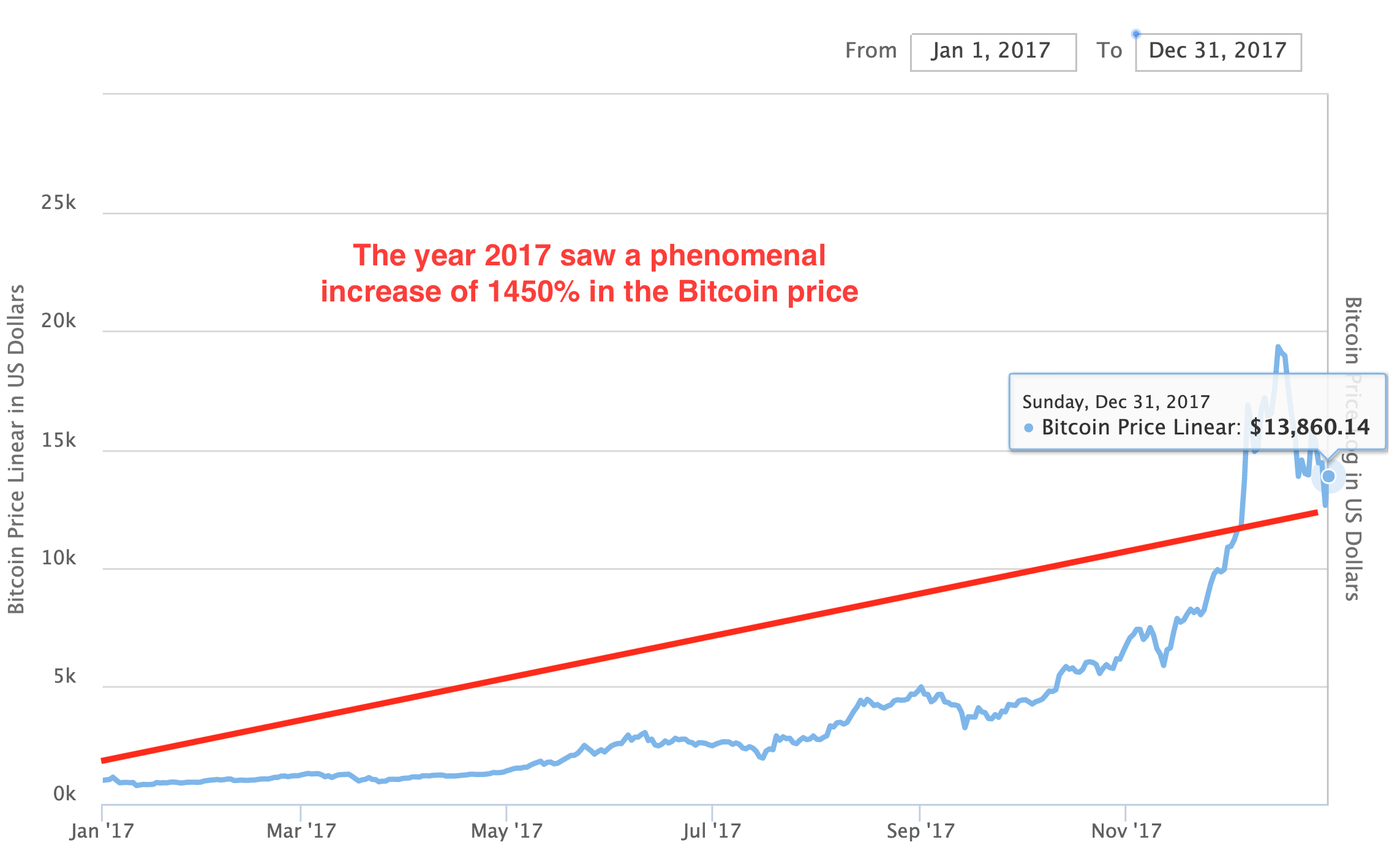

I think this will pass in time – but that time may be still several years away. The spectacular rise in market value of Bitcoin and its imitators has focused people’s interest in them this interest in turn leads to exchange market liquidity, and broader adoption, for monetary purposes or just experimentation. Interest in cryptocurrencies tied to dollars or gold, and which thus do not have dramatic increases in market value by design, has not been too great. Oddly enough, I’ve found that the qualities of stability and reliability are not valued today. Probably, these themes will become a lot more prominent after Bitcoin falls in value, a lot (perhaps from much higher levels), or has a long period of whipping up and down while trending nowhere. Anyone who was paid in an unchanging number of Bitcoins would be ecstatic, except their employer would be out of business. Anyone who made a loan in Bitcoin at the beginning of 2017 would be ecstatic today – the value of their debt rising multiples in dollars – except that their borrowers would default, leaving them nothing. We want money to be as stable and reliable as possible, to serve as a store of value and a basis for long-term contracts. Over time, I think people will realize that a highly volatile instrument like Bitcoin makes a great trading sardine, but does not make good money. But, I think the “fundamental” demand for Bitcoin (and its relatives) as a transactional tool continues to grow underneath. Speculative demand – demand which can turn into supply in an instant – probably represents most of that. So, we are already near that figure today, and I don’t think it is because there are a billion people holding $300 each. Expand this up to 1 billion people, which is not too silly, and we have $300 billion of Bitcoin market cap.īitcoin’s market cap was recently $267 billion, at a price near $16,000/Bitcoin. The “demand” for Bitcoin that results is thus 100 million X $300, or $30 billion of Bitcoin market cap. They don’t really care too much about the value of Bitcoin in terms of dollars, because they are only holding $300 of it. Their individual holdings are going up and down, as they buy and sell things, but on average it is $300. Let’s say that, over time, 100 million people – only about 1/70 th of the world’s population – acquires $300 each of Bitcoin, for transactional purposes. Once they acquire $1000 or so of Bitcoin, they trade it for $20 Federal Reserve notes, which they consider a more reliable store of value. Given the stark volatility of Bitcoin, perhaps they don’t want to hold onto this for too long. They start with $100 of Bitcoin, and gradually get more as payment for goods and services. Or, maybe they are sellers who want to see if accepting payment in Bitcoin is good for business.

Maybe they just want to try it out, and see if it might be used to their advantage. Perhaps the seller insists on it, or perhaps it would be better than alternative means. Let’s imagine that some of these millions of people decided to acquire $100 of Bitcoin, not as a speculation, but simply as a means of payment. Other options for these people consist largely of in-person transactions involving paper money, and perhaps gold or outright barter. It can be used by anyone with a smartphone, which includes millions – perhaps, billions – of people in places like India, Afghanistan, rural China, Cambodia, and all of Africa, who do not have bank accounts, and perhaps don’t want to have one.

It does not make use of the banking system, and does not leave a paper trail. It is a nearly-costless way of transferring value over long distances, and (supposedly) anonymously. Bitcoin has proved itself to be quite useful for certain things.

0 kommentar(er)

0 kommentar(er)